When it comes to life insurance, quality is just as important as quantity, so know your options!

All American Armed Forces members are automatically enrolled in SGLI and TSGLI. If the servicemember is married, they’re also enrolled in FSGLI. All costs associated with these programs are deducted from the servicemember’s pay. Coverage for military families through these three is incredibly important, but with minor adjustments, you can significantly increase you family’s protection with no additional cost.

Defining Your Coverage

SGLI — Servicemembers Group Life Insurance, which provides $400,000 of life insurance for $28/month. You must have SGLI to get TSGLI or FSGLI.

TSGLI — Traumatic SGLI, which costs $1/month to provide up to $100,000, if your servicemember suffers a traumatic injury, including loss of limb, sight, or other trauma.

FSGLI — Family SGLI, which provides up to $100,000 of coverage on spouses for $5/month for spouses under 35 (and slightly more for older spouses). It also includes $10,000 coverage on each child.

Is that enough?

It depends on your family’s needs, but $400,000 would only last a typical family about 8 years. Even if it was invested prudently, and combined with DIC (Dependency and Indemnity Compensation), it may not be enough to ensure a strong financial foundation for the future.

Can I do better?

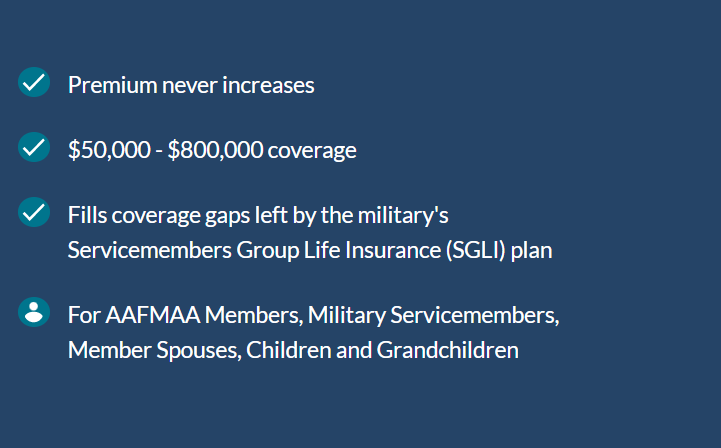

AAFMAA — the American Armed Forces Mutual Aid Association — provides Level Term insurance for the American Armed Forces, with $400,000 costing only $18.15/month. This is not just less expensive, but because it will last after your servicemember leaves the military — until age 50 (age 40 if you are a smoker). Most importantly, it comes with AAFMAA’s exclusive Survivor Assistance Services. At the time of a Member’s death, AAFMAA will coordinate with Social Security, the VA, and others to ensure that your family gets all of the military, Veterans, Social Security, and other benefits to which they are entitled.

Should I cancel SGLI?

You should not necessarily cancel your SGLI entirely. Instead, do the following:

- Apply for AAFMAA coverage at $400,000 for $18.15 per month at www.aafmaa.com.

- Reduce your SGLI to $100,000 (which would cost just $7.00 per month).

- Keep your TSGLI and spouse coverage at $100,000 (total = $6 per month).

The total cost is $31.15/month — less than you are paying now — and provides a total of $500,000 of life insurance, continues after the military, and includes survivor assistance services. The AAFMAA Level Term policy includes $10,000 of child’s life insurance, so children would have a total $20,000 of coverage.

Payments could still come from pay reflected on your servicemember’s LES, just as they do today. Fill out an application online, or call (877) 398-2263) to begin AAFMAA Level Term 1 insurance for $400,000. Then fill out two simple forms at finance: SGLV Form 8286 will reduce your SGLI to $100,000 and DD Form 2558 to start your AAFMAA allotment.

Also members of the American Armed Forces who are E-5 through O-3 and start a $250,000 or greater life insurance policy by allotment can get a $4,000 Career Assistance Program (CAP) loan at just 1.5%.

Story originally published January 23, 2015.