By Charlene Wilde

Senior Vice President and Assistant Secretary, AAFMAA

Guest Blogger

Does thinking about life insurance make your head spin? It’s one of those things everyone — especially Military Families — should have, but it can be daunting to think about the options if it’s a topic you’ve never dived into before. But, here’s some good news you may not have heard: AAFMAA let’s Military Spouses purchase life insurance for their families. So when your servicemember is away and you have a choice to make, you can make it on your own.

That’s the “easy” part. Now, let’s look at the details together and see if we can clear up the rest of it for you.

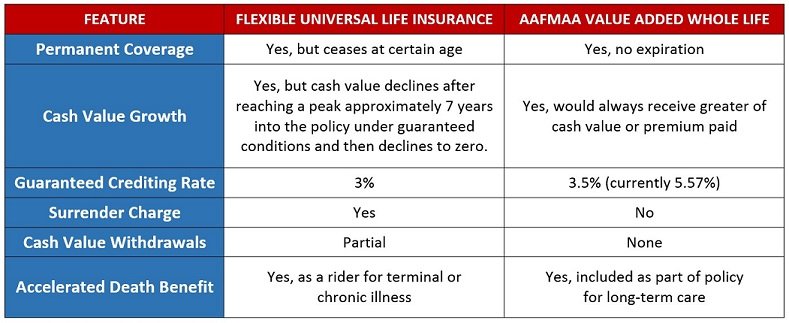

There are two types of permanent life insurance policies to consider: Flexible Universal life insurance and Value Added Whole Life. As long as you pay your premiums, you maintain coverage. Both also grow cash value and, upon first glance, appear to be the same. When purchased for young children, premiums are very low and these policies provide a wonderful way to teach them about cash growth. So, which one is a better choice for your Military Family?

Recently I evaluated the insurance coverage my spouse and I purchased for our two children 10 years ago. We purchased $50,000 in coverage for a fixed monthly premium of $15 thinking this was not only a great value, but also a way to build cash value for their future. In fact, my parents purchased the same policy for me when I was young. So what was good for them is good for us, right?

Well… I recently checked on the cash growth of my own policy, thinking that after 30 years, there would be a nice nest egg. It was shocking to discover that it had stopped accumulating growth and it was only slightly higher than my children’s policies. This discovery led me to investigate other options. Specifically, I compared an AAFMAA Value Added Whole Life policy to my current coverage.

Below are my findings regarding coverage growth, and policy features:

As you can see, AAFMAA’s Valued Added Whole Life policy is a much better long-term option for me. So, what did I do? I requested a “1035 exchange” from the universal life company and applied that amount to new policies at AAFMAA. A 1035 exchange is a provision under IRS code that allows one to replace a permanent life insurance policy with a similar policy without tax implications. AAFMAA’s Membership and Sales Team made the whole process very easy and explained all the steps to me.

I encourage you to take a look at your coverage and evaluate whether you are truly getting the best value for your hard earned money. The Membership and Sales Team at AAFMAA can help if you have any questions. Just call: 877-398-2263.

RELATED: Charlene explains why AAFMAA Membership is great for Military Families.

RELATED: Get Charlene’s PCS tips.

More About Life Insurance & AAFMAA:

Solutions for Your Military Family:

Life Insurance, Wealth Management, Home Mortgages, Survivor Services, and more. Learn more about AAFMAA.