1. Look at your total household income every month, after taxes and any IRA contributions (note: if you have the option to contribute to an IRA and don’t- you should be!). Then, write down total income per month.

2. List all NECESSARY expenses. Example: mortgage, electricity bill, groceries, etc. Please note, “necessary expenses” unfortunately don’t include shoe shopping, manicures, eating out.

3. Write down the amount of debt you have (if any). It is extremely important to find out how much debt you have and how much interest you are paying on the debt. Make an action plan to get out of debt. If the debt is from credit cards and unnecessary expenses, this should end now! The action plan should include a budget amount of how much you will be paying off every month with an end goal written down of when the debt will be completely paid off. This should be a major priority for your budget sheet. The monthly budget allotment for paying off the debt should be included in your budget sheet until all debt is paid off.

4. Based on your “necessary” expenses, and paying off debt, now you can see how much you can afford to save and invest every month, even if it’s a small amount. You should always be saving. Experts often say to have 3-6 months worth of income always in your savings account, some refer to this as the “emergency fund”.

5. Always have money allocated or saved for expenses that may not be an “every month” expense such as car repair or unexpected medical bills; in other words, some type of necessary expense that you would need in order to maintain your health and job.

6. As long as all the items above stay within your monthly household income, now you’re to the point you can view what is left to spend on any miscellaneous expenses such as eating out, shopping, traveling. Unfortunately this category takes the last priority for budgeting. The good news is once you’ve been budgeting for a while, pay off all debt, and have saved significantly to catch yourself up to where you should be (though you should never quit saving), the amount in this category will be able to go up over time.

7. Throughout your budgeting process, make sure you are tracking every expense regardless of amount. Even if it’s a Starbucks beverages twice a week for 5 dollars per beverage, this adds up to an average of $40 a month and an average of $500 a year. Track every single expense; everything from the smallest to largest amount. Small expenses add up and can easily get out of control if not managed properly.

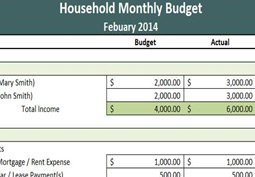

8. A great way to create a budget tracker is on excel (check out the example above). You can download a template through excel to create your own.

9. This is one of the most important rules of thumb: stay within your means! Don’t budget outside your means- then the budgeting has no point.

10. Always (try) to save more than you spend and (absolutely) never spend more than you make.

What are some other budget tips that have helped you?