I’ve been exploring some advice from successful people lately and seeing what I can learn from them. I’ve found that much of what these extraordinary people say can be applied to managing your money.

Let’s peek into the minds of some of the most successful people around. Whatever your goal may be, it always helps to get some advice along the way. And when it comes to money, why not seek out that advice from extraordinarily wealthy people?

Here are some sayings from these winners and some actionable tips on how to apply their rich knowledge to your personal finances.

1. “I don’t think of work as work and play as play. It’s all living.” –Richard Branson

Wise words from Sir Branson, here. He’s reminding us that work can be play and vice versa. As far as our personal finances go, we traditionally think of saving as boring and spending as fun. I’ll speak from personal experience when I say that clicking a “transfer funds” button into my savings account is not as fun as buying a new pair of shoes.

Unfortunately, it is in our nature as human beings to do fun things more often than the un-fun things. We love to play. So to entice ourselves to save, we should take Branson’s advice and make saving a playful activity. Instead of begrudgingly sticking money into a savings account every month, we could find ways to invest it and watch it grow. Here are some ideas:

- Set goals for yourself and “race” to savings totals among a group of friends or family.

- Celebrate your saving successes: Go ahead and buy that pair of shoes, but only after you reach a particular savings milestone.

- Invest in industries that you genuinely have an interest in; researching companies won’t be a chore if it means reading about something you already love.

- Use beautiful and fun applications that help you save better, like Mint.com and GoodBudget.

So when it comes to your work and your money, make it playful. It’s all living.

2. “Doing the best at this moment puts you in the best place for the next moment.” –Oprah Winfrey

If you watch her TV network or read her magazine (quite a resume, right?), you know that Oprah is a huge proponent of goal setting. Acknowledge what you want tomorrow and start working toward it today.

Especially when it comes to finances, our long-term goals are most easily achieved if we start positioning ourselves for them now. Here are some things you can do with your finances at this very moment to have a fruitful next moment:

- Think about opportunity cost before you make frivolous purchases. That $5 you spend now is $50 you can’t spend later.

- Set priorities and stick to them. Incentivize yourself to save or invest by thinking about what you’ll use the money for.

- Make investing a part of your routine! Even if the amount seems small, make saving or investing a part of your everyday life, or a fixed expense in your monthly budget. Saving is easier, and more rewarding, if you do it on a regular basis.

Every investment you make has an opportunity cost.

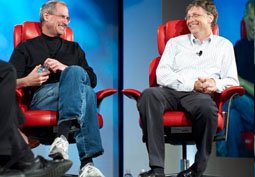

3. “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Don’t let yourself be lulled into inaction.” –Bill Gates

Here’s one way to interpret what Mr. Gates is saying: 1) invest early and 2) have patience.

The time value of money works such that the earlier a dollar is invested, the larger a sum it can potentially grow to become. So listen up, teenagers: Contribute to your 401(k), even if you’re earning a measly wage at a part-time job. And hey, young professionals! Start investing through mutual funds or ETFs, even if your balance feels small. They may not pay off immediately, but they will pay dividends in the long term. When saving, avoid inaction. Even a tiny step forward is better than staying in the same place.

Investing in your future isn’t something that starts when you “grow up” or “settle down” or make a certain amount of money. It should happen now. Don’t underestimate the big rewards that can come from small actions.

4. “Winners never quit, and quitters never win.” –Vince Lombardi

Hey, nobody’s perfect. Even the hallowed coach Lombardi lost a few games. So financially, allow yourself failures. There will be financial setbacks in life — unexpected expenses, gaps in employment, impulse purchases that we later regret. But losing a battle doesn’t mean losing the war (or the league championship).

When these hardships come along, savings and investments can seem like easy places to cut back. But heed the coach’s wisdom here: Challenges aren’t a reason to quit. Maybe savings deposits become smaller, but they shouldn’t completely disappear. Keep going, keep saving, and keep setting goals. Winners never quit, therefore winners don’t go broke.

5. “I think if you do something and it turns out pretty good, then you should go do something else wonderful, not dwell on it for too long. Just figure out what’s next.” –Steve Jobs

The founder of Apple could have easily been talking about diversification here. Invest in as many wonderful things as possible and don’t put all your eggs in one basket. Diversifying our investments is the safest way to build wealth.

But Jobs’ quote here is also about not putting a ceiling on what you can achieve (or save). Steve Jobs was nothing if not ambitious. He set his sights on changing the world — and he did. So with our income, let us set our sights just as high. By its nature, money grows exponentially; the more you have, the more you can make. So don’t limit yourself with small goals. Building wealth shouldn’t be about putting a finish line in the sand and crossing it. It should be about continuing to look forward and figuring out what’s next.

This refrain from Jobs is actually a common theme from these extremely successful people: Aim high. In 2014, let’s not be afraid to set some big financial goals and make it a habit to work toward achieving them every day.

Dividend stocks can make you rich. It’s as simple as that. While they don’t garner the notoriety of high-flying growth stocks, they’re also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

What’s the best personal finance advice you ever received?